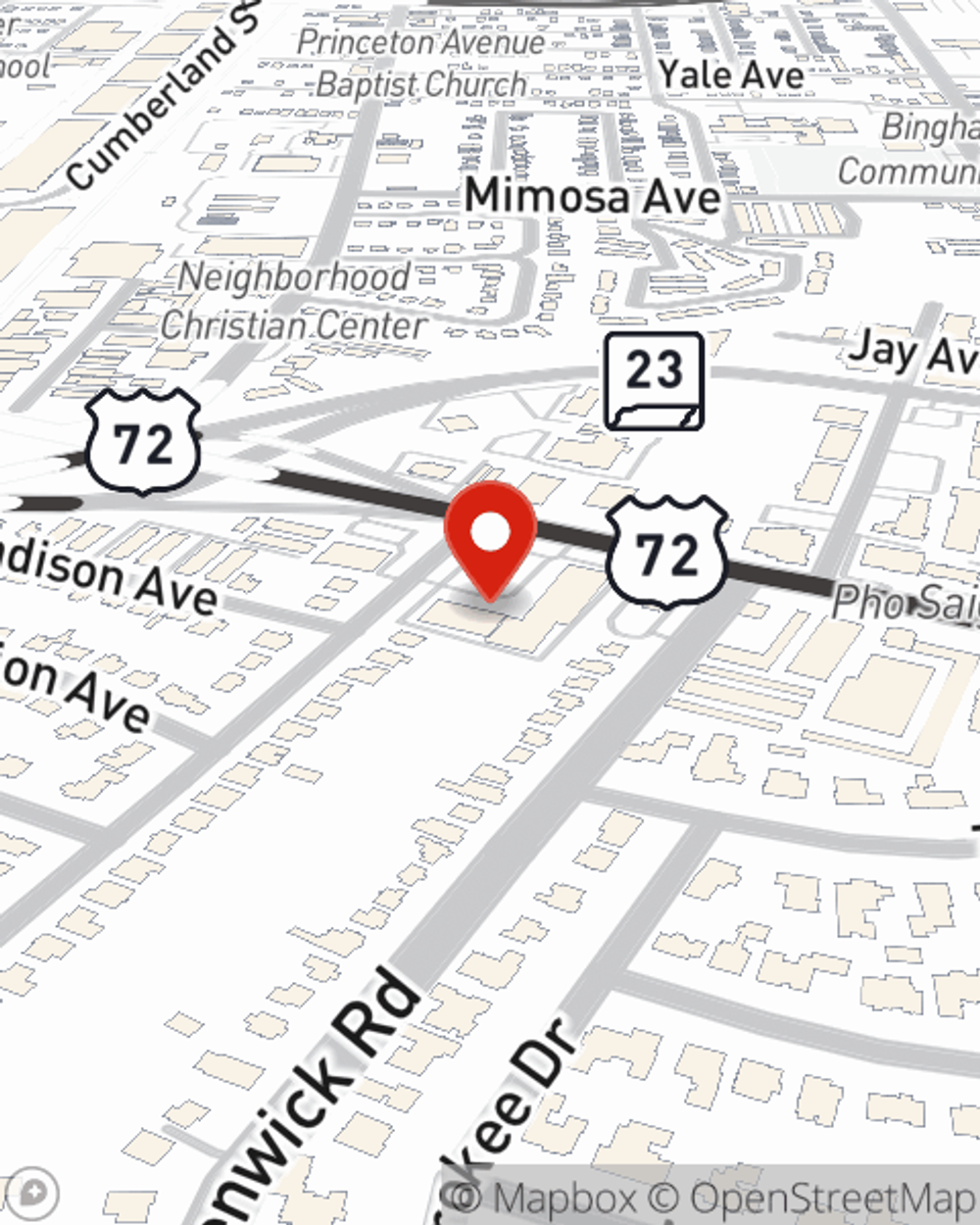

Condo Insurance in and around Memphis

Looking for great condo unitowners insurance in Memphis?

Condo insurance that helps you check all the boxes

There’s No Place Like Home

Looking for a policy that can help insure both your condo unit and the linens, furnishings, mementos? State Farm offers impressive coverage options you don't want to miss.

Looking for great condo unitowners insurance in Memphis?

Condo insurance that helps you check all the boxes

Safeguard Your Greatest Asset

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Kevin White can be there whenever you have problems at home to help you submit your claim. State Farm is there for you.

There is no better time than the present to call or email agent Kevin White and ask any questions you may have about your condo unitowners insurance options. Kevin White would love to help you select the smartest policy for you.

Have More Questions About Condo Unitowners Insurance?

Call Kevin at (901) 652-8484 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Kevin White

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.